Liquor Lovers Beware: Maharashtra Increases Taxes, IMFL Prices May Jump 60%

Maharashtra hikes excise duty on liquor, pushing IMFL prices up by over 60%. Country and imported liquors also costlier as the state seeks higher revenue.

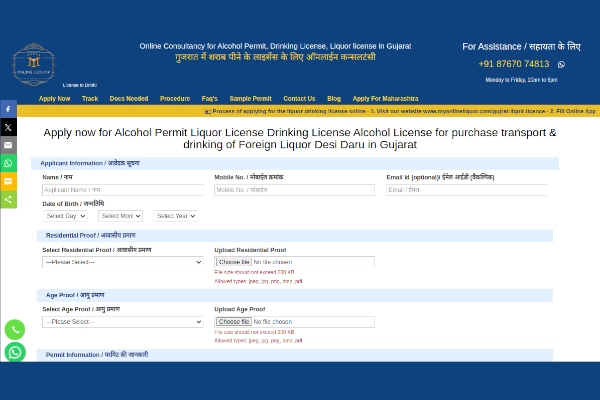

It is advisable to have alcohol/liquor drinking license in Maharashtra. You can apply online for alcohol/liquor drinking liquor license in Maharashtra here : Click Here to Apply Now

A sudden surge — what changed?

On June 10–11, 2025, the Maharashtra cabinet approved a major increase in excise duties:

IMFL (Indian-Made Foreign Liquor) duty raised from 3× manufacturing cost to 4.5× — a hike of 50%+, translating to over 60–85% jump in retail prices.

Country liquor duty increased from ₹180 to ₹205 per proof litre (~₹70 → ₹80 per 180ml) — a 14% increase .

Imported premium liquor will see prices rise by 25%+ .

Beer and wine duties remain untouched, in line with state efforts to promote its wineries and maintain beer pricing .

Why Maharashtra’s government pulled the trigger

Fiscal urgency: The state aims to boost excise revenue to approximately ₹57,000 crore for FY 2025–26 — an increase of ₹14,000 crore over FY 2024–25 .

Funds will support initiatives like Ladki Bahin, farmers’ subsidies, and other welfare programs.

A panel formed in January 2025 under Additional Chief Secretary Valsa Nair made recommendations adopted by the cabinet in June .

Spotlight on Maharashtra-Made Liquor (MML)

Introducing a new grain-based category:

Feature Notes

Price: ₹148 per 180ml, positioned between country liquor and IMFL

Category: Taxed like country liquor, sold under FL‑2/FL‑3 licences

Objective: Revive 70 local units (only 32 active); support grain farmers and politicians with distilleries

Impact on stakeholders

📌 Consumers

Sharp price hikes: Regular IMFL rises 60–85%; country liquor ∼14%; premium IMFL 25%+ .

Cost shift: Beer and wine remain stable—could encourage consumers to shift toward these options.

Illicit risk: Experts caution that steep hikes might encourage cross-border smuggling or consumption of unsafe illicit liquor .

📌 Industry

Premium IMFL outlook: Analysts believe demand is resilient, supported by young consumers drawn to premiumization .

Mixed stock response: Shares of United Spirits, United Breweries, Allied Blenders slumped by 3–8% post-announcement .

Beer industry reaction: Brewers welcome the zero-hike on beer, noting beer is already taxed heavily—up 32% over past decade .

Associations’ warnings: CIABC cautions that abrupt price hikes could hurt volumes, drive downtrading, illicit trade, and threaten legitimate sales .

Local revival push: MML is seen as a strategy to help domestic units regain market share after being outcompeted by foreign brands .

What lies ahead — predictions & outlook

Revenue: The government expects the hike to deliver ~₹14,000 crore extra in FY 2025–26.

Market dynamics: Short-term volume drop possible. Premium remains stable; mass-market may suffer .

Cross-border pressures: States like MP and Goa with lower excise could become sources for smuggling.

Behavioural shifts: Consumers may pivot to beer, wine, or MML. Illicit/unlicensed channels may gain traction.

🧭 For Consumers & Businesses: What now?

Consumers: Consider stocking up on IMFL before new prices kick in; beer and wine offer a stable respite.

Bars & restaurants: Update menus and pricing soon. Push beer, wine, and possibly MML as alternatives.

Retailers: Align with new wholesale rates, notify regular buyers, and manage inventory to match shifting demand.

Distillers: Weigh price absorption policies vs. label changes (old MRPs must be replaced by Aug 31).

Final take

Maharashtra’s excise duty overhaul marks its most aggressive liquor tax reform in 14 years—reshaping consumer behavior, industry economics, and state revenue streams. The introduction of MML shows a clever policy prototype blending local empowerment with price buffering. However, vigilance is critical to monitor unintended consequences: illegal trade, retail slowdown, and social impact. Only time will reveal whether the strategy balances fiscal ambition with market realities.

How to get drinking liquor license in Maharashtra: Click Here to Apply Now